Getting a clear picture of your monthly payments for a new recreational vehicle is the first step to securing confident finance. A loan calculator provides straightforward repayment estimates, helping you compare your options, manage your budget effectively, and move forward with peace of mind. Learn how the calculator works with your figures, explore the range of vehicles you can finance, understand the key terms that influence your borrowing costs, and navigate the application process from initial pre-qualification to final approval. Discover solutions for those with less-than-perfect credit, realistic repayment examples, and common customer questions. Gain the knowledge and tools needed to easily estimate and secure tailored recreational vehicle finance.

How Does A Recreational Vehicle Loan Calculator Work?

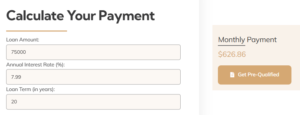

A recreational vehicle loan calculator estimates your monthly repayments by combining your desired loan amount, deposit, interest rate, and loan term to provide clear budgeting figures. This process simplifies your planning and boosts your financial confidence before you even apply.

To use the calculator:

- Enter the vehicle price and any deposit you plan to pay upfront.

- Select the loan term (in months or years).

- Input the annual interest rate (APR) that’s been offered or that you estimate.

- Click Calculate to view your estimated monthly payment and the total amount payable.

Each step helps build a precise cost profile for your chosen vehicle, whether it’s a boat, RV, or powersports vehicle. Understanding these inputs sets the stage for the accurate projections you’ll find in the following sections on required data, calculation methods, and adjustable parameters.

What Inputs Do You Need to Provide for Accurate Calculations?

To get the most accurate repayment estimates, you’ll need to provide precise details. Please supply:

- Vehicle price (the total cost of the vehicle).

- Deposit amount (any upfront payment you can make).

- Loan term (the duration of the loan in months or years).

- Annual percentage rate (APR) or interest rate.

- Any optional fees (such as arrangement or documentation charges).

Each piece of information refines your estimated monthly repayment and the overall cost of the loan. Providing realistic figures now means fewer surprises when you apply for finance later.

How Are Monthly Payments and Total Loan Costs Calculated?

The calculator uses standard formulas to generate two key outputs: your estimated monthly repayment and the total amount payable over the life of the loan.

| Calculation Element | Formula Component | Purpose |

|---|---|---|

| Loan Principal | Vehicle price − deposit | Determines the total amount to be financed. |

| Monthly Interest Rate | APR ÷ 12 ÷ 100 | Converts the annual APR into a monthly rate. |

| Number of Payments | Loan term (years × 12) | Sets the total number of repayments required. |

| Total Amount Payable | Monthly payment × number of payments | Shows the cumulative cost of the loan over its entire term. |

By structuring repayments this way, you can clearly see both your ongoing monthly commitment and the full cost of borrowing, empowering you to make well-informed financial decisions.

Can You Adjust Loan Terms, Interest Rates, and Deposits?

Yes, a calculator features dynamic sliders and input fields that allow you to test various scenarios. You can:

- Adjust the loan term to see how extending or shortening the borrowing period affects your monthly costs.

- Modify the APR to model the impact of higher or lower interest rates.

- Increase your deposit to reduce the financed amount and, consequently, the overall interest paid.

Experimenting with these variables helps you understand the trade-offs between shorter terms with higher payments and longer terms with greater total interest. This flexibility allows you to find a repayment structure that best suits your budget.

How to Calculate Boat Loan Payments with Our Boat Finance Calculator

Boat loans often come with specialized rates and may require marine surveys. Our boat finance calculator:

- Considers typical marine APRs.

- Allows you to include survey costs as part of your initial deposit.

- Shows monthly repayments over terms extending up to 10 years.

By modeling these specific factors, you’ll gain clear visibility of your potential boat loan commitment before you even seek pre-approval.

What Are the Benefits of Using the RV and Camper Finance Calculator?

Financing a RV or camper involves balancing features, loan duration, and cost. This calculator:

- Integrates average APRs specific to recreational vehicle finance.

- Offers flexible terms—often up to 15 years for larger vehicles.

Your estimate will reflect realistic monthly commitments, helping you compare lenders and prepare for the ongoing costs of ownership.

How Does the Camper Finance Calculator Help You Plan Your Budget?

Camper loans can sometimes include zero-deposit options and insurance packages. With a calculator tool, you can:

- Explore zero or low-deposit scenarios.

- Factor in the cost of optional insurance premiums.

- Project repayments for both new and pre-owned campers.

This clarity ensures you set aside the appropriate budget for your travel adventures and vehicle payments.

What Are the Key Loan Terms You Should Understand Before Using the Calculator?

Understanding these core finance terms is crucial for correctly interpreting the calculator’s results. Each term influences your monthly commitment and the total cost of your loan, so knowing their definitions, how they work, and their benefits will lead to smarter borrowing decisions.

- APR (Annual Percentage Rate) – the annual cost of borrowing, expressed as a percentage.

- Loan Term – the total duration over which you will repay the loan.

- Deposit – the upfront payment you make, which reduces the amount you need to finance.

- Total Amount Payable – the cumulative sum of all your repayments over the loan term.

A solid grasp of these terms forms the foundation for using the calculator effectively and negotiating with lenders confidently.

What Is APR and How Does It Affect Your Loan Repayments?

APR represents the total annual cost of your credit, encompassing both interest charges and any mandatory fees. A lower APR means a lower monthly payment and less interest paid overall, while a higher APR increases your borrowing costs. For instance, a 1% reduction in APR on a $30,000 loan over five years could save you hundreds of dollars in interest, making your repayments more affordable throughout the term.

How Do Loan Terms and Deposit Amounts Impact Monthly Payments?

Longer loan terms generally result in lower monthly repayments, but they also mean you’ll pay more in total interest over the life of the loan. Conversely, a larger deposit reduces the amount you need to borrow, cutting both your monthly costs and the overall interest expenses. Finding the right balance between loan term length and deposit size is key to aligning your repayments with your budget and long-term financial goals.

What Does Total Amount Payable Include in Recreational Vehicle Loans?

The total amount payable includes all your scheduled repayments, plus any arrangement fees or mandatory insurance premiums. This figure reveals the true cost of your credit, going beyond just the vehicle’s purchase price. By reviewing this total, you can avoid unexpected costs and compare different finance offers on an equal footing.

How Can You Apply for a Recreational Vehicle Loan?

Once you’ve determined a repayment plan that works for you, proceeding to the application stage is straightforward. This process uses your estimated figures to help you secure pre-qualification and formal approval without any unintended impacts on your credit.

Follow these steps:

- Pre-qualification: Submit basic information for an initial eligibility check.

- Documentation: Provide the necessary paperwork for verification.

- Final Approval: Receive your formal offer and agree to the terms.

What Is the Pre-Qualification Process and Does It Affect Your Credit Score?

Pre-qualification involves a soft credit check, which means it won’t appear on your credit report. By confirming your approximate eligibility levels, you can compare finance options without risking your credit score. This makes your budgeting decisions safer and more informed.

Which Documents Are Required to Complete Your Loan Application?

To finalize your loan application, please have the following ready:

- A valid photo ID (such as a passport or driving license).

- Proof of address (a utility bill or bank statement).

- Recent payslips or bank statements to verify your income.

- The vehicle quotation or invoice from the seller.

How Long Does It Take to Get Loan Approval with Elite Direct Finance?

Once we receive your submitted documentation, most customers can expect a formal decision within 24–48 hours. This rapid turnaround is thanks to our strong relationships with multiple lenders and our streamlined processes, all designed to get you on the road as quickly as possible.

Can You Get Recreational Vehicle Finance with Bad Credit Using Our Calculator?

Yes, our calculator can help you explore finance options even if you have a less-than-perfect credit profile. By modeling different interest rates and deposit scenarios, you can assess the feasibility of your options before applying, saving you time and helping to protect your credit health.

Elite Direct Finance offers flexible solutions designed to accommodate a wide range of credit histories, making suitable rates accessible to more applicants.

How Does Using the Calculator Help You Understand Your Eligibility?

By entering your potential APR and deposit levels, the calculator will show you realistic monthly repayments for each scenario. This insight helps you determine which options are affordable and highlights when you might need to adjust your budget or deposit to improve your chances of approval.

What Tips Can Improve Your Chances of Loan Approval with Poor Credit?

- Increase your deposit to reduce the amount you need to finance.

- Pay down existing debts to improve your affordability ratios.

- Provide clear proof of stable income and a consistent address history.

- Avoid making multiple loan applications in a short period.

Implementing these steps can strengthen your application and potentially lead to more favourable loan offers.

What Are Typical Examples of Loan Repayments for Different Recreational Vehicles?

Representative repayment examples can help clarify what you might expect for common vehicle types.

The table below shows sample monthly costs based on typical APRs, loan terms, and deposit levels.

| Vehicle Type | Sample Monthly Payment | Assumed APR | Term | Deposit |

|---|---|---|---|---|

| Boat ($40,000 total) | $640 | 7.5% | 120 months | 10% ($4,000) |

| RV or Camper ($60,000) | $850 | 6.9% | 150 months | 15% ($9,000) |

| ATV ($10,000) | $190 | 9.2% | 48 months | 10% ($1,000) |

These examples reflect typical financing conditions as of December 2025, helping you benchmark your own estimates and plan accordingly.

How Much Can You Expect to Pay Monthly for a Boat Loan?

Financing a $40,000 boat over ten years at 7.5% APR with a 10% deposit typically results in monthly payments of around $640. Knowing this figure upfront helps you compare lenders and budget for additional ownership costs like insurance and maintenance.

What Are Sample Monthly Payments for RV and Camper Loans?

For a $60,000 RV financed over 12.5 years at 6.9% APR with a 15% deposit, repayments average $850 per month. Campervans, which are often smaller and less expensive, might cost approximately $500–$600 per month under similar terms, offering flexible leisure options for various budgets.

How Do Powersports Vehicle Loan Repayments Compare?

An ATV or motorcycle priced at $10,000 over four years at 9.2% APR with a 10% deposit typically requires payments of about $190 per month. Shorter terms and potentially higher APRs on powersports finance can lead to higher monthly costs, but they also mean quicker ownership and less total interest compared to longer terms.

What Frequently Asked Questions Do Customers Have About Using Elite Direct’s Loan Calculator?

Customers often seek clarification on how the tool integrates with real-world finance processes, its impact on credit scores, and eligibility criteria. Anticipating these questions ensures you can use the calculator effectively and proceed to application with confidence.

How Does a Camper Finance Calculator Work?

The camper finance calculator uses your inputs—vehicle cost, deposit, APR, and term—with an amortization formula to calculate your monthly repayments and the total amount payable. This instant estimate allows you to test zero or low-deposit scenarios for practical budget planning.

Will Applying for Finance Affect My Credit Score?

Pre-qualification checks use soft credit inquiries that do not affect your credit rating. Only a formal application, which involves a full credit check, may leave a record on your file. Therefore, testing estimates first helps preserve your credit profile.

Can I Get a Loan for a Jet Ski or Personal Watercraft?

Yes, the calculator can accommodate personal watercraft. Simply enter the purchase price, your desired deposit, and the loan term. It will then generate a tailored repayment plan reflecting typical powersports APRs and terms.

What Are Typical Interest Rates for Boat Loans in the US?

In the US, boat APRs commonly range from 6.5% to 9%, depending on the vehicle’s age, the deposit size, and your credit profile. Entering a realistic APR within this range will ensure your repayment estimate aligns with current market conditions.

How Much Can I Finance for a Motorhome or RV?

Most lenders allow financing amounts from $5,000 up to $150,000 for motorhomes and RVs, with loan terms typically ranging from five to 15 years. Using the calculator with your specific figures will provide precise repayment figures for any amount within this range.

By exploring each of these sections, you’ll gain a comprehensive understanding of how our loan calculator supports your recreational vehicle financing journey, ensuring clarity, flexibility, and confidence every step of the way.

Ready to turn your estimates into reality? Use our loan calculator at Elite Direct Finance today to outline your monthly payments and take the first step towards your next adventure.